Ad Disclosure

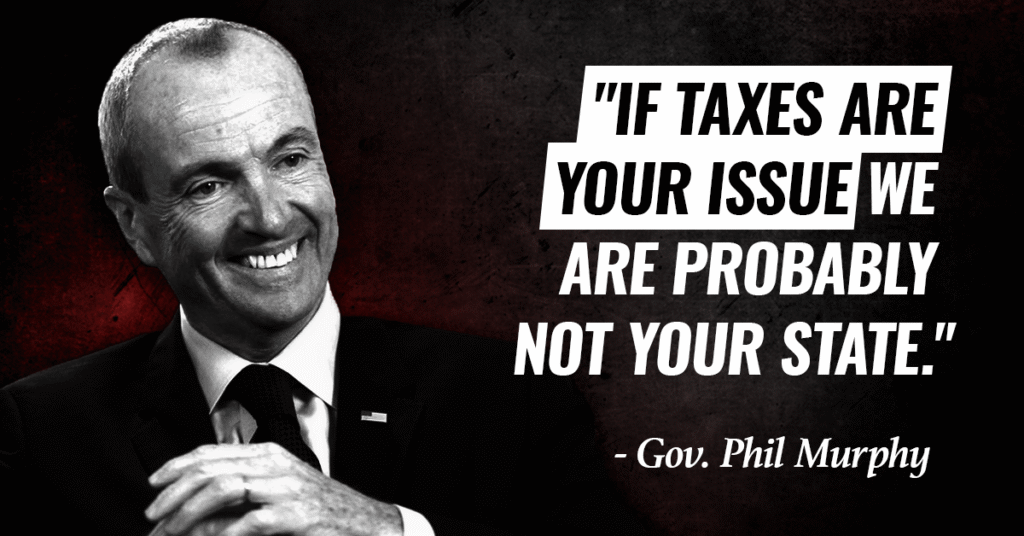

[Breaking] NJ Wants More of Your Winnings With NJ Casino Tax Increase

By Pete Amato

Published:

Another day, another grab for the gambling money. This time they’re coming for us Jersey folks. (Like our taxes aren’t already high enough!)

New Jersey Governor Phil Murphy just proposed a major tax hike on New Jersey online casinos and NJ sports betting apps in his FY2026 budget plan, unveiled February 25, 2025. The governor’s proposal calls for raising the state’s tax rates on online casinos from 15% to 25% and sports betting taxes from 13% to 25%, a move that’s expected to generate an additional $402.4 million in revenue.

Now, that might sound like it’s all about boosting the state’s coffers. But here’s the thing: That money doesn’t just come out of the casinos’ pockets. It comes out of yours.

The Real Impact on You, the Player

In theory, higher taxes mean more money for the state — but in practice, they could mean fewer promos and less value for players. Here’s how:

- Smaller Bonus Offers: Expect fewer eye-popping NJ online casino bonuses and lower match percentages. When operators have to give more of their revenue to the state, they’re less likely to throw around massive bonuses.

- Tighter Comp Programs: If casinos need to protect their margins, you might notice changes in comp programs. Players who rely on free play or reward points could find those harder to earn.

- Reduced Game Variety: With higher taxes, some operators might hold back on adding new games, like the infamous Sauce Boss BBQ Slots or features to their platforms. Why launch the next big slot game when you’re going to lose a big chunk of the revenue from it?

Yes, you can access the official New Jersey FY2026 budget details through the state’s Treasury Department. The full budget document is available here: Official Website.

What NJ Gambling Industry Insiders Are Saying

Governor Murphy’s proposal was outlined in his FY2026 budget, which was unveiled on February 25, 2025. The budget outlined a plan to boost state revenue by increasing taxes on online gambling, which has been a growing revenue stream since the state legalized online casinos back in 2013.

Industry insiders are already raising concerns about the potential impact of these tax hikes. Jeremy Kudon, a representative from the Sports Betting Alliance, said increasing sports betting taxes could price out consumers and hurt operators’ ability to invest in new products.

This will only make things more expensive for customers and slow down innovation in the industry.

And he’s not wrong. When operators are forced to pay more in taxes, you can bet they’ll find a way to recoup that money. The question is, will it come at the expense of your next big bonus or free bet?

Why You Should Care Now

If you’re a regular online casino player in New Jersey, this is the time to lock in those offers and take advantage of what’s still on the table. New Jersey’s iGaming revenue continues to climb, and the state wants a bigger slice. But that’s not your problem — it’s just something you’ll need to navigate as an informed player.

It’s also important to keep an eye on the fine print. New regulations and tax increases could also change how promotions are structured. Will you get less free money upfront and more back-end rewards? Will the terms of your favorite online casino’s loyalty program change? Only time will tell.

Best Online Casinos in NJ (May 2025)

Given the uncertainty around the proposed tax hike, it’s more important than ever to play at the casinos that give you the best bang for your buck — before those promo codes start shrinking. Here are the top NJ casinos to check out right now:

Still Have Questions? We’ve Got You Covered.

If you’re wondering how the NJ casino tax increase in 2026 might affect you, don’t worry — we’ve got all the answers you need. Check out the FAQs below for more details on what this change means for online casino players in New Jersey.

What is the NJ casino tax increase in 2026?

- The proposed NJ casino tax increase in 2026 would raise the tax rates on online casinos and sports betting operators from 15% and 13% to 25%. This change is part of Governor Phil Murphy’s FY2026 budget plan and is expected to generate an additional $402.4 million in revenue for the state.

How will the NJ casino tax increase affect players?

- Players may see smaller bonuses, reduced comp programs, and a slowdown in the rollout of new games or features. Operators are likely to pass on some of the increased tax burden to customers in the form of fewer promotions and possibly tighter payout structures.

When will the NJ casino tax increase take effect?

- The proposed tax hike is part of Governor Murphy’s FY2026 budget plan, which was unveiled on February 25, 2025. If passed by the state legislature, the increase could go into effect in the upcoming fiscal year, starting July 1, 2025.

Pete Amato is a highly experienced writer and digital content strategist specializing in the sports betting and online casino industries. With over 15 years of expertise, he is known for crafting high-impact, credible content that delivers trusted insights across major gaming and betting platforms.